As of March 1, 2023, parcels headed to most European Union (EU) countries will see increased customs regulations. Any goods sent to or passing through certain EU member states must have Harmonization System (HS) codes applied to customs forms. As a result of this change, the United States Postal Service (USPS) will now require an HS Code be applied for any goods sent to certain EU countries. These new regulations are designed to increase efficiency, accountability, and limit fraud and security threats on imported goods.

Compliance with this new mandate and regulations help:

- Avoid fines, delays, and penalties associated with noncompliance.

- Reduce security and safety risks.

- Ensure timely and efficient delivery.

- Prevent customs delays and/or return of non-compliant mail items.

What are Harmonized System Codes

Harmonized System Codes (also referred to as Harmonized Codes, HS codes, HS Tariff codes, etc.) are universally recognized codes for imported goods. HS codes are used to describe and classify imported goods. They follow the “Harmonized System Nomenclature.” HS codes allow for smoother entry and accurate customs and tariff charges. Once an order reaches an international border, customs officials identify goods and assess appropriate taxes, duties, and fees for items you ship.

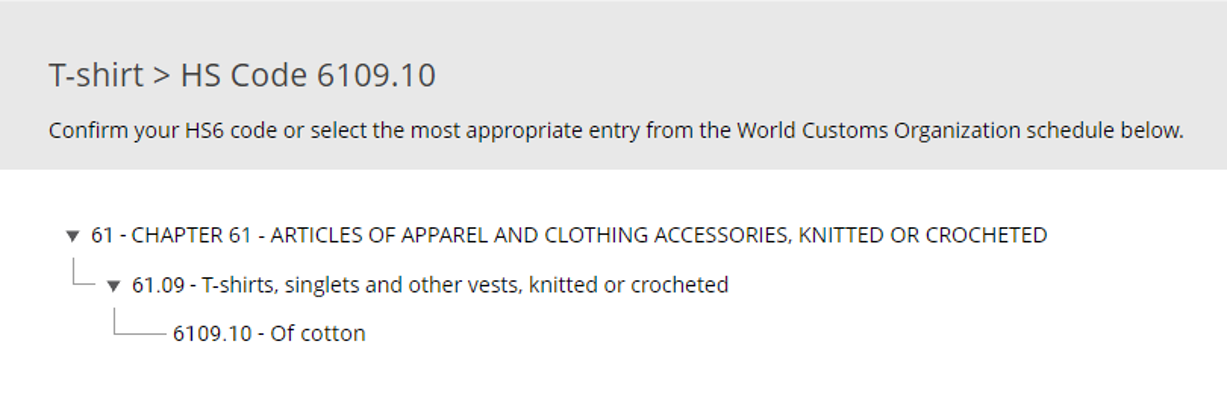

HS codes allow customs officials to quickly identify the contents of a parcel. These codes are six digits long and are comprised of a chapter, heading and subheading. The first two digits are the chapter. This is the broadest category for the item. The second two digits are the heading. And the last two digits are the subheading—these are separated by a period. Let’s look at a cotton t-shirt as an example.

- Chapter 61 is for articles of knitted or crocheted apparel.

- Heading 09 is for t-shirts.

- Subheading .10 is for the material being cotton.

Tools like the Harmonized Tariff Schedule or the more premium Global Tariff Classification Research Tool for Trade.gov Users grant access to detailed lists of HS codes.

And that’s not all. This HS code will also allow you to determine the cost of duties and taxes for your parcel by using GlobalPost’s free Duties and Taxes Calculator

What are Customs Descriptions?

An equally important requirement for shipping to the EU is providing detailed customs descriptions. These descriptions help provide the appropriate HS codes for each item shipped internationally. These are descriptions of each item that a parcel contains. Historically, the EU has not strongly enforced regulations based on what people write. However, vague descriptions like “gift,” “clothing,” or “artwork” will no longer be acceptable descriptions by the EU.

Instead of generic terms like “Clothing” for a t-shirt, you would need to provide a detailed customs description such as “T-shirts, singlets and other vests, knitted or crocheted made of cotton.” This terminology is not something you are necessarily expected to know off the top of your head. Instead, there is a wide range of resources available to help you write the appropriate descriptions. One such tool that provides descriptions is the EU’s Guidance on Acceptable and Unacceptable Terms for the Description of Goods. GlobalPost takes guesswork out of customs declarations by being able to add HS codes to a shipment’s customs forms when the correct customs descriptions are applied.

Acceptable HS Code Descriptions

Benefits of the EU Requiring HS Codes

Properly filled-out customs forms have always ensured timely and efficient delivery to international recipients. A major benefit of HS codes is that they help you and customers avoid additional charges upon delivery. Additionally, they shorten transit times by moving goods through customs quickly—causing fewer delays for all senders and recipients. A quicker delivery time then leads to increased satisfaction buying internationally.

Conversely, failure to comply with customs regulations can always lead to additional charges. Improperly applied customs can set unrealistic expectations that result in customers having to pay more duties and taxes to receive their goods. Or, if the sender covers the customs fees, you may be left paying the import fees. Either way, this may result in returned items or the shipment being treated as abandoned. In this case, no one wins.

GlobalPost Free HS Classification Service: GlobalPost wants international shipping to be hassle-free

Here at GlobalPost we want to make shipping to Paris as easy as shipping to Portland, so we are waiving the requirement to include tariff codes on every shipment. Instead, focus on properly describing your goods (see above) and we’ll handle the work of applying tariff codes.

Still want to do it yourself? No problem, we also provide access to a free HS Tariff Code lookup tool. Use the tool to find your tariff code and include it with your shipment. Once you have your tariff code you can also use that tariff code to determine your duties and taxes with our free duty / tax calculator.

About GlobalPost

GlobalPost is the leading international shipping carrier for small and medium-sized businesses. Through our world-class customer service, easy-to-use technology, and seamless integrations with the world’s top shipping platforms, we help retailers expand into new international markets while saving them money. To learn more about GlobalPost, call us at (888)-899-1255 or send us an email.